Best salary structure for employees between 3 lake-12 lake

- The Finance Minister made several proposals on the personal tax regime in the Union Budget 2020 presented in Parliament on February 1 , 2020.

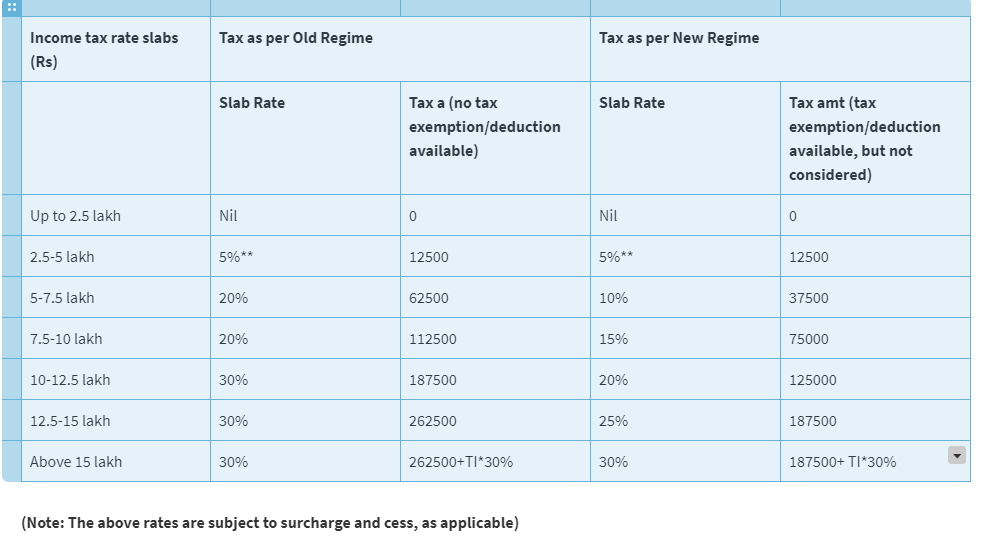

- Budget 2020 introduced a new tax system for individual taxpayers. Bringing a revolutionary change in direct tax rates, Finance Minister Nirmala Sitharaman has proposed a new tax regime to introduce new tax slabs.

- Brief description of exemption and deduction not in new regime

- Outside:-

- Here are some of the 70 exemptions you won't get in new regime. Check which of these you claimed earlier:-

- Standard deduction: 50,000Rs

- House rent: depends on salary structure and rent paid

- Rs 3.5 lakh for affordable housing, Rs 2 lakh for others

- Sec 80C investment: Rs 1.5 lakh

- Leave travel allowance: tax-free if one in two years

- Contribution NPS: Rs 50,000

- Medical premium: Rs 25,000 (Rs 50,000 for parents and seniors)

- Savings bank interest: Rs 10,000 Sec 80TTA

- Interest income (for senior citizens): Rs 50,000

- Interest in education loans: interest paid eight consecutive years

- Self-dependent disability: Rs 75,000 to Rs 1,25 lakh depending on disability

- Self or dependent disease treatment: Rs 40,000 (Rs 1 lakh for senior citizens)

- Donations to specified entities: 50-100% of donations.

- Stays:-

- The budget left some 50 tax exemptions untouched. These include:

- Standard rent deduction: 30% rent received

- Agricultural income: unlimited

- Life insurance income: if insurance is 10 times the annualized premium

- Retrenchment compensation:

- VRS works: Rs 5 lakh

- Leave retirement encashment: Rs 3 lakh (No worker limit)

- * Basic exemption income slab for residents aged 60 or older (senior citizens) and residents aged 80 or older (very senior citizens) at any time in the previous year remains the same for Rs 3 lakh and Rs 5 lakh, respectively, under the existing tax regime.

- * * Can take Rebate under section 87A, i.e. no Rs. 500,000 taxable income (TI) tax.

- First, if you're a wage person or want to opt for a new tax regime, you'll need to inform your employer through the declaration form. The employer starts deducting tax at source (TDS) for each month. Learn which tax option suits you.

- So, in the table above you can see that in the new tax scheme, the tax rate is lower that could provide relief to individual taxpayers, but before that, there are some terms and conditions to choose the new tax scheme you need to know

- 1) The new tax regime is optional, meaning the assessor can choose between the New Tax Regime or the Old Tax Regime

- 2) The New Tax Regime is only applicable if you are willing to relinquish exemptions (such as Leave Travel Allowance (LTA), House Rent Allowance (HRA), etc.) and deductions (such as 80C, 80CCC, 80CCD, 80DD, 80E, 80EE, 80GG, 80GGG, 80GGA, 80GGC, etc.) under various sections of the Income Tax Act , 1961.

- 3) Only a deduction under Section 80CCD(2) [i.e. an employer's contribution for an employee under a notified pension scheme] and Section 80JJJAA [i.e. Can be claimed for new job].

- 4) Standard deduction for salaried persons under Section 16 [currently Rs 50,000] shall be disallowed

- 5) Home loan interest deduction under Section 24(b) shall also be disallowed

- So, that's right.

- This new scheme is confusing for people generally earning between 25k-1 lakh per month or a wage person. Now taxpayers try to figure out whether the new structure is beneficial or old. Several websites have released calculators to help individuals figure this out. The Department of Income-Tax itself launched an e-calculator to estimate tax liability under the new tax slabs. It compares taxes in old and new tax schemes.

- But another point of view is anyone claiming tax exemptions and deductions in excess of Rs 2.5 lakh in a year won't gain from the new structure.

- This Rs 2.5 lakh threshold includes standard Rs 50,000 deduction that requires no investment. All wage taxpayers are eligible, leaving only an additional deduction of Rs 2 lakh. Section 80C investments take care of Rs 1.5 lakh. Also, the average taxpayer claims HRA exemption or claims deduction for interest paid.

- Since the new tax regime has multiple tax slabs with lower tax rates, but most deductions are not available (see table). Each individual will have to assess which regime is in his favour, depending on the deductions and exemptions he plans to claim. Anyone claiming more than a year's Rs 2.5 lakh deduction (including the Rs 50,000 standard deduction) won't gain from the new structure. The Rs 2 lakh threshold will be easily crossed if you live on rent and claim HRA exemption or take home loan and claim interest deduction. Taxpayers who claim full deduction under Section 80C would better adhere to the older tax regime.

- But remember, once you make the choice, you can't switch to the other for the remainder of the financial year in terms of salary TDS. However, when filing the tax return, the employee will have the right to choose whether to go for the new tax system or stick with the old one. Keep in mind, however, that certain exemptions can only be claimed through the employer so that they may not be available when returning. If more tax is paid, the taxpayer can claim a return refund.