WHAT ACCOUNTS TO OPEN FOR NRI - NON RESIDENT INDIA

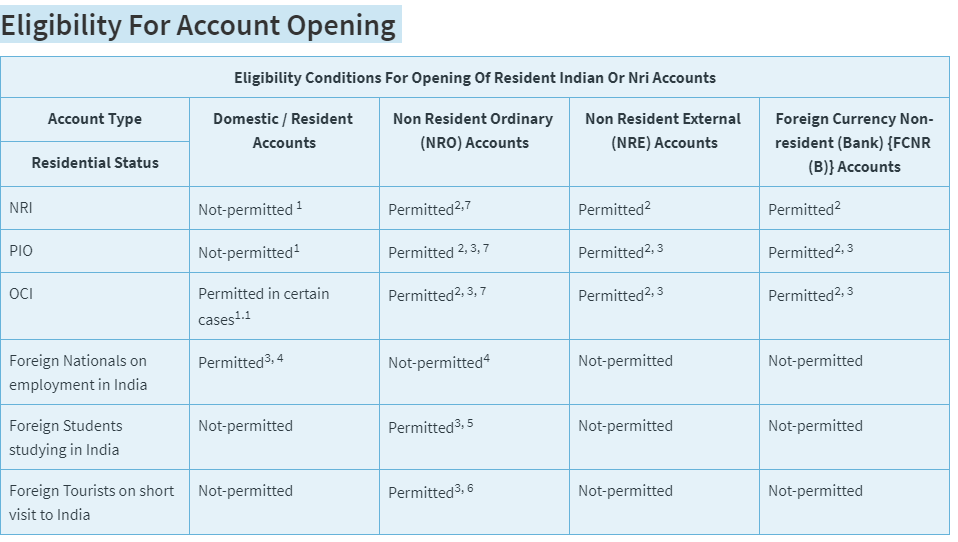

1 However, subject to the following conditions, a joint account may be opened with a resident Indian (RI) who is a close relative:

-- Allowed mode of operation is 'Either or Survivor'

-- The primary / first account holder in the common account will be the RI and the second claimant will be the NRI (PIO / OCI)

1.1 If OCI arrives in India with the intention of remaining indefinitely and stays more than 182 days, it shall forfeit the rights available to NRIs / PIOs / OCIs. This OCI is expected to re-designate / convert its NRE / NRO / FCNR accounts to a resident account or, as the case may be, the NRE / FCNB account to an RFC account. An OCI can also open all kinds of accounts that a resident customer is allowed to open.

2 A joint account may also be opened with a resident Indian (RI) who is a close relative, subject to the following conditions:

-- Allowed mode of operation is 'Former (NRI) or Survivor' only

-- The primary / f would be the NRI (PIO / OCI)

-- First the joint account holder and RI the second claimant

3 The following applicable conditions:

-- Pakistani National will need prior RBI approval before account opening.

-- The Foreign Registration Office (FRO) / Foreign Regional Registration Office (FRRO) concerned must have a valid visa and residential permit issued by Bangladesh National.

4 Foreign nationals arriving in India on employment and leaving India may convert their domestic account to an NGO account in order to allow them, subject to certain conditions, to receive their legitimate dues. However, RBI 's approval would require continuation of the account beyond 6 months.

5 NRO account shall be opened for International Students studying in India on the basis of their passport (with sufficient visa and immigration approval) containing proof of identity and address in their home country, along with a photograph and letter of admission from the educational institution, subject to:

-- Within a period of 30 days from the opening of the account, the foreign student should apply to the branch where the account is opened a valid proof of address in the form of a rental agreement or a letter from the educational institution in the form of a proof of residence in the facility given by the educational institution. Banks should not rely on the landlord visiting the branch to verify the rent documents and banks may follow alternative means of verifying the local address.

-- The account should be run within 30 days with a condition of enabling foreign remittances not exceeding USD 1,000 in the account and a monthly withdrawal ceiling to Rs 50,000/-, pending address verification.

-- Upon submission of the current address evidence, the account will be regarded as a regular NRO account and run in compliance with existing instructions.

6 Account continuation beyond 6 months will require the approval of RBI.

7 The opening of NRO accounts is not authorised for NRIs (including PIO / OCI) residing in Nepal or Bhutan.

-- Allowed mode of operation is 'Either or Survivor'

-- The primary / first account holder in the common account will be the RI and the second claimant will be the NRI (PIO / OCI)

1.1 If OCI arrives in India with the intention of remaining indefinitely and stays more than 182 days, it shall forfeit the rights available to NRIs / PIOs / OCIs. This OCI is expected to re-designate / convert its NRE / NRO / FCNR accounts to a resident account or, as the case may be, the NRE / FCNB account to an RFC account. An OCI can also open all kinds of accounts that a resident customer is allowed to open.

2 A joint account may also be opened with a resident Indian (RI) who is a close relative, subject to the following conditions:

-- Allowed mode of operation is 'Former (NRI) or Survivor' only

-- The primary / f would be the NRI (PIO / OCI)

-- First the joint account holder and RI the second claimant

3 The following applicable conditions:

-- Pakistani National will need prior RBI approval before account opening.

-- The Foreign Registration Office (FRO) / Foreign Regional Registration Office (FRRO) concerned must have a valid visa and residential permit issued by Bangladesh National.

4 Foreign nationals arriving in India on employment and leaving India may convert their domestic account to an NGO account in order to allow them, subject to certain conditions, to receive their legitimate dues. However, RBI 's approval would require continuation of the account beyond 6 months.

5 NRO account shall be opened for International Students studying in India on the basis of their passport (with sufficient visa and immigration approval) containing proof of identity and address in their home country, along with a photograph and letter of admission from the educational institution, subject to:

-- Within a period of 30 days from the opening of the account, the foreign student should apply to the branch where the account is opened a valid proof of address in the form of a rental agreement or a letter from the educational institution in the form of a proof of residence in the facility given by the educational institution. Banks should not rely on the landlord visiting the branch to verify the rent documents and banks may follow alternative means of verifying the local address.

-- The account should be run within 30 days with a condition of enabling foreign remittances not exceeding USD 1,000 in the account and a monthly withdrawal ceiling to Rs 50,000/-, pending address verification.

-- Upon submission of the current address evidence, the account will be regarded as a regular NRO account and run in compliance with existing instructions.

6 Account continuation beyond 6 months will require the approval of RBI.

7 The opening of NRO accounts is not authorised for NRIs (including PIO / OCI) residing in Nepal or Bhutan.